by mulcair-cu | Dec 3, 2024 | Latest News

Here are the talented winners of our 2024 Art Competition!

A big congratulations to you all, and we are delighted to announce that you will advance to the second stage of the competition.

Thank you to all participants for sharing your creativity with us.

by mulcair-cu | Nov 27, 2024 | Latest News

Starting 6th January 2025, Mulcair Credit Union will operate under new opening hours to better serve you:

📅 Monday: Closed

📅 Tuesday: 9:30 AM – 5:00 PM

📅 Wednesday: 10:00 AM – 5:00 PM

📅 Thursday: 9:30 AM – 5:00 PM

📅 Friday: 9:30 AM – 5:00 PM

📅 Saturday: 9:30 AM – 1:00 PM

📍 Murroe Office: Open Fridays from 10:00 AM – 4:00 PM

We’re here to help you with all your financial needs! 😊

by mulcair-cu | Nov 23, 2024 | Latest News

12 tips for Fighting Fraud this Festive Season: Be Informed, Be Alert, Be Secure – Be FraudSMART

As we approach the festive season, FraudSMART is here to ensure your safety. Both consumers and businesses need to be vigilant against frauds and scams during this busy time.

Everyone is a target especially with the increasing complexity of frauds and scams and during the festive season when we’re all busy enjoying this time of year. Fraudsters target us through various channels, including emails, social media, and phone calls.

Here are 12 essential tips to help you stay safe:

- Never click on unsolicited links in texts or emails.

- Avoid public Wi-Fi for online purchases; use a secure connection.

- Keep your computer’s security up to date with reliable antivirus and browser software.

- Shop directly from trusted retailers’ websites.

- Be cautious of unbelievable deals or miracle products.

- Use reputable payment suppliers or Verified by VISA/Mastercard Secure Code.

- Watch out for fake calls from your bank or utility companies.

- Purchase tickets from secure and reputable websites.

- Limit personal information sharing on social media.

- Avoid saving passwords on your mobile device unless necessary, and protect your phone with a passcode.

- Your bank will never ask for your full PIN or online banking passwords. If in doubt, call your bank using the number on your card.

- Report any suspected fraud to your bank immediately.

Stay safe and enjoy the festive season without falling victim to scams. Be vigilant and share these tips with your loved ones to help protect them as well.

Wishing you a secure and joyful holiday season.

by mulcair-cu | Oct 8, 2024 | Latest News

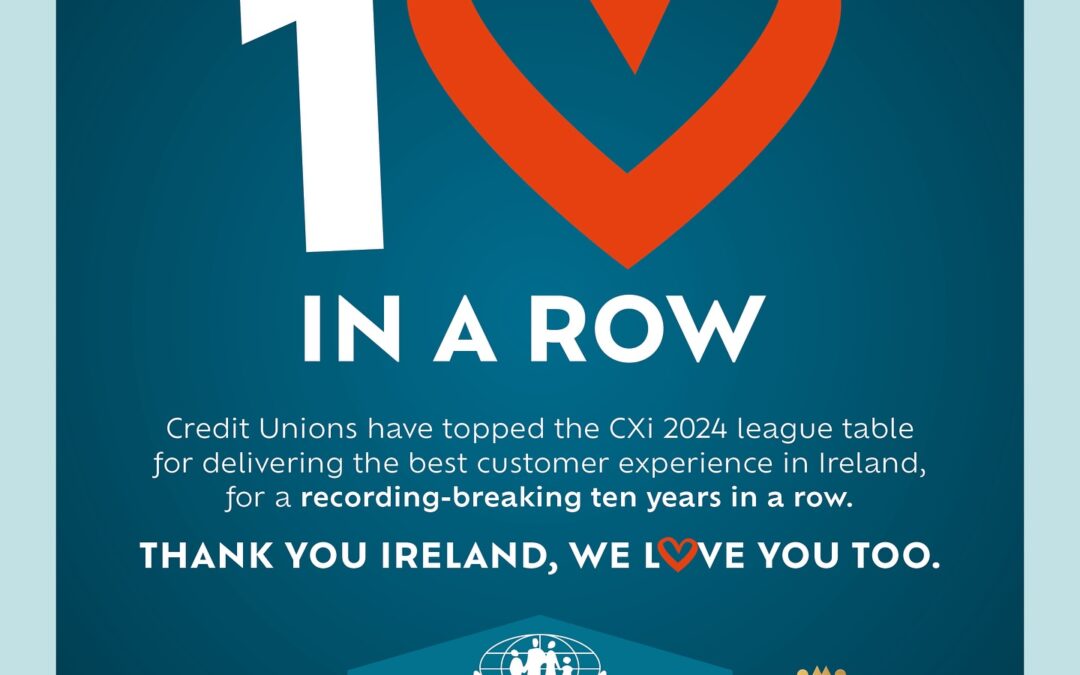

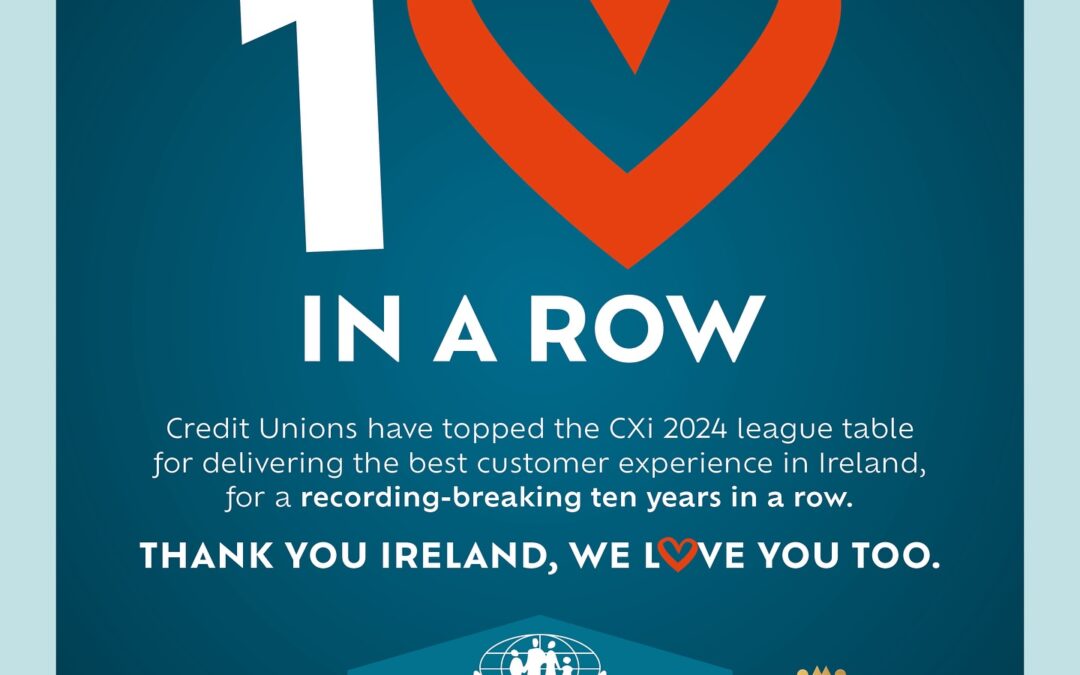

For a record-breaking 10th consecutive year, credit unions have topped the league table for best customer experience in Ireland, according to the 2024 Customer Experience Insight (CXi) Report. Furthermore, credit unions are also the only brand to have maintained a constant presence in the top ten since the survey began ten years ago, a testament to the consistency of their CX excellence.

Credit unions achieved an incredible overall CX score of 8.26, with a score of more than 8.0 considered to be the measure of CX Excellence. In contrast, the average score in the financial services sector was 6.91.

The CXi survey sought feedback from consumers across a diverse range of areas including their perspective on emotional drivers related to brands and how it impacts them, their interaction experience with brands, cost of living experiences, sustainability and the use by brands of new technologies such as AI, to name a sample.

Commenting on the announcement, Alice Grant, Head of Brand & Member Experience of the Irish League of Credit Unions (ILCU) said that the ILCU was delighted to see that credit unions continue to set the standards when it comes to delivering superior customer experience.

“This unprecedented tenth win is recognition of the dedication and hard work of credit union staff and volunteer directors across Ireland. Their relentless focus is always on being there for our members and for communities which we serve

She continued:

“There has been a great deal of change in credit unions in recent times with enhanced digital journeys and new product offerings. What hasn’t changed, and what won’t change, is our absolute commitment to put our members first. Our unique social ethos allows us to focus solely on how to best deliver for our existing and potential new members, rather being focused on profiting from their needs”

The CXi Report is published annually and is based on a survey which is carried out by Amarách Research. This year’s survey ran from June 8th to the 30th of July 2024. A representative cross section of Irish consumers was asked to give feedback on their experiences with 150+ companies across 11 sectors.

by mulcair-cu | Sep 4, 2024 | Latest News

Fraudsters are continually coming up with new ways to convince students to hand over deposits for properties that don’t exist or have already been rented to multiple tenants, with some even going as far as sending a fake contract and fake keys. They prey on students who feel panicked due to accommodation shortages and pressure them into paying a deposit without doing the necessary checks.

Remember if its too good to be true it probably is!

Our advice to students and parents:

- Familiarise yourself with the average rent price in your search area. If the rent is unusually low and it seems too good to be true, it usually is!

- Do your research, check the Eircode and visit the accommodation to make sure it exists as advertised.

- Check short-term rental sites to ensure the property is not being used by a fraudster for “viewings” who will take your deposit money.

- It is crucial to keep copies of all correspondence between you and the advertiser, including bank details and the advertisement itself. The best approach is to use legitimate well-known rental agencies. If this is not possible, don’t hand over any money until you have seen the property and are happy with its condition.

- Do not make payments until you have been given the keys and signed the rental contract.

- Always check that the keys fit in the lock.

- Remember, don’t transfer any money unless you have carried out all the relevant checks and you are absolutely sure that the listing is genuine.

- Do not be embarrassed if you have been scammed. Report it to your local Garda Station and contact your bank.

By staying alert and taking steps to protect yourself, you can reduce your risk of falling victim to fraud and avoid becoming target for scammers.