by mulcair-cu | Nov 25, 2025 | Latest News

🎉 We are delighted to share the news that credit unions have ranked in first place in the Ireland Sustainability Reputation Index 2025.

Now in its fourteenth year, the Index, carried out by The Reputations Agency , tracks the perceptions of 5,500 members of the informed public on the sustainability measures undertaken by 100 prominent organisations in Ireland.

Credit unions secured the top overall score of 78.0, placing first in seven of the 16 key sustainability factors, include Excellent ratings for:

❤️ Supporting good causes

🤝 Fair in the way it does business

🏘️ Improving the lives of people and their communities

✨ Positively influencing society

by mulcair-cu | Oct 23, 2025 | Latest News

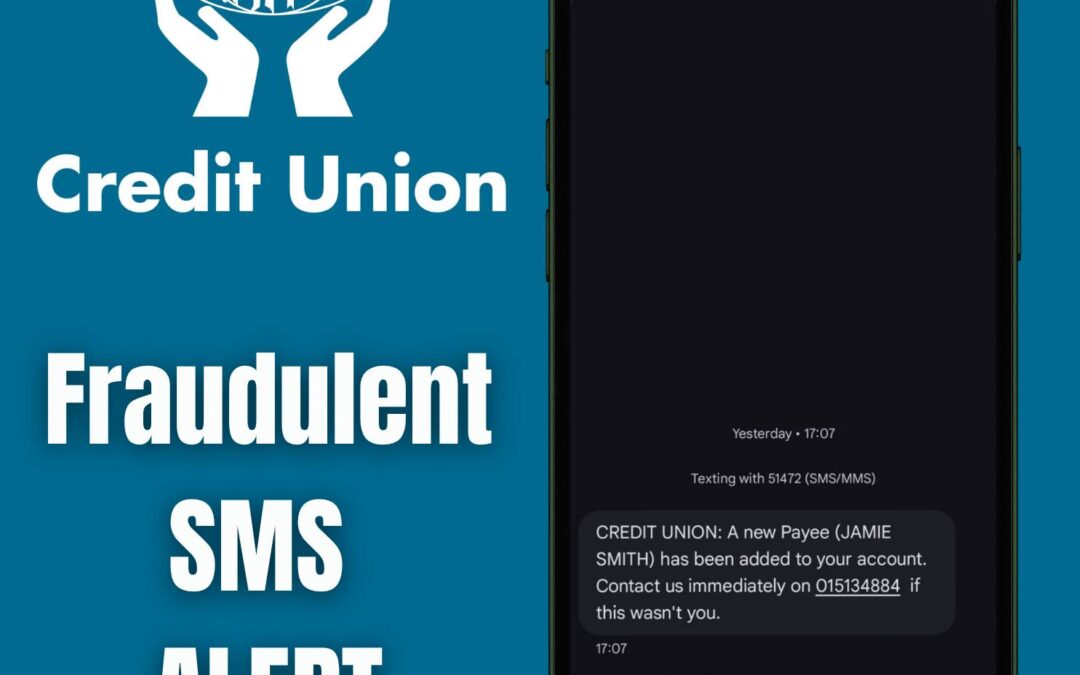

Fraudulent SMS Alert

Dear Members,

We’ve been made aware of a fraudulent SMS currently circulating nationwide. The message appears to come from “51472” and reads:

CREDIT UNION: A new Payee (JAMIE SMITH) has been added to your account. Contact us immediately on 01 513 4884 if this wasn’t you.

When the recipient calls the number provided (01 513 4884), the call is answered with “Welcome to Credit Union Services.” The caller is then persuaded to provide their account credentials and personal details to the fraudster.

⚠️ This is a scam. If you call the number, you’ll reach fraudsters pretending to be Credit Union staff who will try to get your personal and account details.

👉 Please remember:

- Your Credit Union will never ask for account details, passwords, or PINs by phone or text.

- Do not click on links or call numbers in suspicious messages.

If you’ve responded or shared any information, contact your Credit Union immediately using our official contact details, and report it to your bank and An Garda Síochána.

Stay alert and keep your information safe! 💙

by mulcair-cu | Sep 11, 2025 | Latest News

It’s that time of year again when we’re encouraging all budding artists to take part in the Credit Union Art competition, that takes place across Ireland.

Mulcair Credit Union is delighted to launch the 2025 Credit Union Art Competition and is calling on local artists of all ages to take part in one of Ireland’s longest running and most inclusive art initiatives. The competition invites people from all walks of life to express themselves through creativity, with this year’s theme asking them to reflect on “The Future is…”

This year’s theme encourages artists to look ahead with imagination, hope and curiosity. Participants might explore personal dreams and milestones, a better world for the next generation, or how change and progress might shape our lives and communities. Whether bold and futuristic or thoughtful and personal, the theme offers endless possibilities for creative interpretation.

Now in its 42nd year, the Credit Union Art Competition continues to support and promote creativity at every stage of life. From early learners to lifelong artists, the competition celebrates the power of art to connect, inspire and bring communities together.

Mulcair Credit Union believes in supporting not only financial wellbeing, but also personal growth and connection through community involvement. The art competition is part of that wider mission, encouraging children and adults alike to think, create and share their ideas with others.

The competition is open to entrants across two categories:

General Category

Additional Needs Category

Each category is broken down into five age groups (based on age as of 31 December 2025):

7 years and under

8 – 10 years inclusive

11 – 13 years inclusive

14 – 17 years inclusive

18 years and over (Adult)

Entries will be judged on originality, creativity and how well the theme is explored.

All artwork must be hand-drawn or painted. Digital artwork will not be accepted. Local winners will go forward to regional and national stages of the competition.

Teachers, parents, community groups and local artists are all encouraged to get involved and help spread the word. Entry forms and competition details are available to download below or by contacting us directly via phone or email.

The closing date for completed entries is Friday October 24th 2025.

Download Art Competition Entry Form

by mulcair-cu | Jul 28, 2025 | Latest News

The Irish League of Credit Unions has released its annual Back to School survey results for 2025, highlighting the rising financial pressures facing families across the Republic of Ireland.

🔍 Key findings from this year’s report include:

- 1 in 3 parents (33%) are now going into debt to cover back-to-school costs

- The average debt per parent has risen to €376, compared to €368 last year.

- 35% of parents say they’ve had to deny their child at least one essential school item due to costs.

- The total cost of sending a child back to school now stands at €1,450 for primary school and €1,560 for secondary school

Commenting on the 2025 findings, David Malone, CEO, Irish League of Credit Unions said: “This year’s back to school survey findings are reflective of the broader pressures being felt across society associated with the increasing cost of living.

“While the fact that 1 in 3 are taking on debt is significant, the research also shows that more and more households are sacrificing to pay for back to school, particularly when compared to recent years”.

Read further information on this year’s report at the following link: https://www.creditunion.ie/news/latest-news/ilcu-back-to-school-research-shows-that-1-in-3-are/

#BackToSchool #CostofLiving #ForYou #CreditUnions #Ireland #EducationCosts

by mulcair-cu | Jul 1, 2025 | Latest News

Mulcair Credit Union is Hiring: Member Services Officer

Mulcair Credit Union currently has a vacancy for the position of Member Services Officer.

We are a member-owned, not-for-profit financial co-operative serving over 7,500 members with an asset size of €49 million. Rooted in the community, we are committed to delivering excellent, ethical financial services and supporting financial wellbeing across our common bond.

About the Role

As a Member Services Officer, you will provide friendly, efficient, and accurate service to our members, supporting a range of financial transactions and administrative duties.

Key Responsibilities

-

Deliver an excellent member service across multiple channels – in person, by phone, and online

-

Carry out front-line services including lodgements, withdrawals, loan repayments, and opening accounts

-

Accurately handle cash, reconcile balances, and account for any shortfalls or excess

-

Update member records and maintain database integrity

-

Assist members with queries and explain our services

-

Perform administrative tasks such as scanning and filing

-

Support team projects and credit union-wide initiatives

-

Participate in ongoing training and development

-

Operate within risk and compliance frameworks including AML policies and procedures

Ideal Candidate Profile

-

Excellent attention to detail and administrative skills

-

Experience in a credit union or similar financial institution is ideal (not essential – training provided)

-

Strong customer service, interpersonal, and communication skills

-

A team player with discretion and sensitivity in member interactions

-

Confident in making decisions and taking responsibility

-

Understanding of the Credit Union ethos

-

QFA/APA qualification or willingness to work toward one upon commencement (full support provided)

How to Apply

Please send your CV and a cover letter to:

📧 patrickkett@mulcaircu.ie

📅 Closing date: Tuesday, 15th July 2025

Shortlisting may apply. Assessment will be based on the information provided in your application.

Mulcair Credit Union Ltd. is an Equal Opportunities Employer.